Staying ahead in the financial world means leveraging the right tools to streamline operations and enhance customer relationships. Financial CRM integration stands as a game-changer, bridging the gap between your customer data and financial performance. It’s not just about managing contacts; it’s about unlocking the full potential of your financial services through smarter, data-driven decisions.

Imagine having a 360-degree view of your customer interactions, transactions, and financial insights, all in one place. That’s the power of integrating your Customer Relationship Management (CRM) system with your financial operations. Whether you’re a small business owner or a finance professional, understanding how to harness this integration can transform your approach to customer service and financial management, setting you up for unprecedented success.

Benefits of Financial CRM Integration

Integrating a Customer Relationship Management (CRM) system with your financial operations isn’t just a step forward; it’s a leap towards operational excellence and unparalleled customer satisfaction. With real-time data at your fingertips, you’re equipped to make more informed decisions, tailor your services to meet customer needs precisely, and streamline your operations for maximum efficiency.

Streamlined Operations

One of the most immediate benefits you’ll notice with financial CRM integration is the streamlined operational workflow. By automating data entry and syncing financial data across platforms, you reduce manual errors and save valuable time. This integration allows for a smoother flow of information between departments, ensuring that everyone has access to the latest data without the need for redundant communication. Efficiency isn’t just an objective; it’s a tangible outcome you can measure in time saved and errors reduced.

Enhanced Customer Relationships

Understanding your customers’ needs and preferences is crucial to fostering long-lasting relationships, and a financial CRM system gives you the tools to do just that. With comprehensive customer profiles that include transaction history, communication preferences, and personal information, you can tailor your interactions to meet their specific needs. Personalised service isn’t just appreciated; it’s expected. By leveraging the insights gleaned from your CRM, you can anticipate customer needs, offer relevant solutions before they even have to ask, and create a customer experience that feels both personal and professional.

Data-Driven Decisions

In today’s fast-paced financial environment, making decisions based on data, not just gut feelings, is crucial for success. Financial CRM integration provides a wealth of analytics and reporting tools that turn raw data into actionable insights. Understand customer behaviour, identify sales trends, and track financial performance with precision. This enables you to:

- Target the right customers

- Allocate resources more effectively

- Forecast future trends with greater accuracy

| Key Performance Indicator | Improvement After CRM Integration |

|---|---|

| Customer Satisfaction | Increase by up to 30% |

| Sales Productivity | Improve by up to 34% |

| Operational Efficiency | Enhance by up to 40% |

These improvements aren’t just numbers; they’re reflections of a deeper understanding of your business dynamics and customer base, facilitated by the integration of your financial systems with your CRM. Armed with this knowledge, you can adapt your strategies to meet changing market demands and customer expectations, positioning your business for ongoing growth and success.

Streamlining Operations with Integrated Systems

When your financial operations sync with your Customer Relationship Management (CRM) system, efficiency isn’t just a goal; it becomes your new reality. Think about the myriad of processes that run through your organisation daily. Now, imagine them operating smoothly, with less manual intervention and reduced chances of error. That’s the power of integration at your fingertips.

By unifying your CRM with financial systems, you’re not just consolidating data; you’re enabling seamless communication between different parts of your business. This synergy leads to the automation of routine tasks. For instance, when a sales rep closes a deal, the information flows automatically into the financial system, generating invoices without any need for manual data entry.

Key Benefits of Automation

- Reduced manual errors: The more you automate, the less room there is for manual mistakes, enhancing the accuracy of your financial records.

- Time savings: Automation speeds up operations, freeing your team to focus on more strategic tasks.

- Real-time data access: Integrated systems provide up-to-the-minute information, critical for making informed decisions quickly.

Furthermore, integrated systems pave the way for enhanced analytics and reporting. With a unified data set, pulling comprehensive reports that encompass both CRM and financial data is straightforward. This means you can track and measure performance across various metrics more effectively.

- Improved financial planning: Access to detailed customer data helps tailor financial forecasts and strategies.

- Enhanced sales strategy: Analysis of both financial results and customer interactions can refine sales approaches for better outcomes.

Consider the insights gained from such analytics. You’ll understand not only who your customers are but also how they interact with your services and products. This knowledge is crucial in today’s competitive markets, where personalisation and efficiency stand as pillars of success.

Adopting integrated systems might seem daunting at first, but the benefits far outweigh the initial hurdles. The transition towards a streamlined operation through CRM and financial system integration is a stepping stone towards not just surviving but thriving in the current business landscape. Organisations adopting this approach have noted not only improvements in operational efficiency but also in customer satisfaction and financial performance.

Enhancing Customer Relationships through Data-Driven Decisions

When you’re aiming to enhance your customer relationships, the blend of financial data with your CRM system proves to be a game changer. By integrating financial metrics and customer data, you’re not just looking at numbers; you’re understanding the story behind every purchase, interaction, and customer journey. This bird’s-eye view allows for data-driven decisions that inherently improve your customer relationships.

One of the primary benefits of financial CRM integration is the real-time access to critical data. This instant access means you can respond to customer queries, concerns, and opportunities faster than ever before. Imagine being able to pull up a customer’s complete financial history with your company in seconds during a conversation. This capability doesn’t just enhance customer service; it transforms it.

Moreover, with all your data centralised, segmentation becomes much more straightforward. You can categorise customers based on various financial metrics such as purchase history, payment behaviours, and service subscriptions. These categories enable you to tailor your marketing and sales approaches to match the specific needs and preferences of different customer segments. Customised interactions are the cornerstone of strong relationships and heightened customer loyalty.

Analytics and reporting receive a significant boost from financial CRM integration. With comprehensive data at your fingertips, identifying trends, forecasting sales, and understanding customer behaviour patterns become much easier tasks. This insight allows you to adjust your strategies in real-time, ensuring they’re always aligned with your customers’ evolving needs.

Financial CRM integration also plays a crucial role in risk management. By monitoring financial interactions and customer behaviour, you can identify at-risk accounts early, allowing you to take proactive measures. Whether it’s a customer consistently late on payments or a sudden drop in purchasing, these insights enable you to address issues before they escalate, safeguarding both your relationship with the customer and your company’s financial health.

Here’s a brief overview of how financial CRM integration impacts customer relationships:

- Real-Time Data Access: Enables swift, informed customer service

- Customer Segmentation: Facilitates tailored marketing and sales strategies

- Enhanced Analytics and Reporting: Improves understanding of customer behaviour and financial trends

- Risk Management: Identifies and mitigates potential financial issues in customer accounts

Implementing Financial CRM Integration Successfully

Integrating financial data into your Customer Relationship Management (CRM) system is a transformative strategy that can unlock unparalleled insights and efficiency for your business. However, the process involves several critical steps to ensure its success. Here’s a concise guide to help you navigate this journey, making the most out of your implementation.

Understand Your Requirements

Before introducing any new system, it’s crucial to have a clear understanding of your business’s unique needs. Identify the key financial metrics that are most relevant to your customer relationships. Whether it’s transaction history, payment behaviours, or credit scores, pinpointing these requirements early will guide your integration process efficiently.

Choose the Right CRM Platform

Not all CRM systems are created equal, especially when it comes to financial integration capabilities. Platforms like Salesforce or Microsoft Dynamics 365, featured on avrion.co.uk, offer robust features that cater specifically to financial services. These platforms provide the flexibility and scalability you need to support your business’s unique financial data integration requirements.

Ensure Data Security and Compliance

When dealing with financial data, security cannot be overstated. Ensuring that your chosen CRM platform complies with regulatory standards such as GDPR is paramount. Look for platforms that offer advanced security features, including encryption and access controls, to protect sensitive financial information.

Seamless Integration Technology

Leveraging the right technology for integration can make a significant difference in the success of your project. Opt for modern API-based integration approaches that ensure a smooth flow of data between your financial systems and the CRM software. Companies like Avrion offer integration services that ensure your systems communicate effectively, reducing the risk of data silos.

Provide Training and Support

The successful adoption of any new system within an organisation largely depends on how well your team understands and embraces it. Offering comprehensive training and ongoing support ensures that your staff can leverage the CRM’s financial integration features to their full potential. Make use of the resources and expertise available from your CRM provider or consulting partners like Avrion to facilitate this process.

By following these steps, you’re not just integrating financial data into your CRM; you’re setting up a foundation for deeper customer insights, more effective marketing strategies, and ultimately, superior customer service. Remember, a well-implemented financial CRM integration is a strong competitive advantage in today’s data-driven marketplace.

Best Practices for Financial CRM Integration

When embarking on the process of integrating financial data into your Customer Relationship Management (CRM) system, it’s crucial to adhere to certain best practices to ensure the initiative’s success. The landscape of financial CRM integration is complex yet immensely rewarding when navigated correctly.

Choose the Right CRM for Your Needs: The foundation of successful financial CRM integration lies in selecting a CRM platform that aligns with your business requirements. Platforms like Salesforce and Microsoft Dynamics 365 are notable for their robust financial integration capabilities. Deciding on the right CRM involves understanding your current processes, future growth expectations, and specific features necessary for your financial operations.

Emphasise Data Security and Compliance: Financial data is sensitive by nature, and its security should never be compromised. Opt for a CRM that offers robust security features and complies with financial regulations and standards such as GDPR and PSD2. This not only protects your data from breaches but also builds trust with your customers.

Opt for Seamless Integration Technology: Integration technology should facilitate rather than complicate the transfer of data between systems. API-based integration is recommended for its ability to provide real-time data exchange and minimise the risk of data silos. Furthermore, it allows for a more customisable integration process, enabling your business to adapt more easily to changes in financial regulations or customer needs.

Ensure Proper Training and Support: The best technology is only as good as the people using it. Ensure that your team is adequately trained on both the CRM and the integration processes. This includes understanding how to input, process, and analyse financial data within the system. Ongoing support is also crucial, as it ensures any issues can be swiftly addressed without disrupting your financial operations.

Regularly Review and Update Your Integration Strategy: The financial industry and its regulations are constantly evolving, and so should your integration strategy. Regular reviews and updates will help you stay compliant and ensure that your system continues to meet your business’s needs.

Implementing these best practices can significantly enhance the efficiency and effectiveness of your CRM system, turning it into a powerful tool that supports your financial operations and enriches customer interactions. By choosing the right platform, prioritising security, employing seamless technology, providing comprehensive training, and maintaining an adaptive approach, you’re well on your way to leveraging financial CRM integration to its fullest potential.

Embracing financial CRM integration isn’t just about staying ahead in the digital curve; it’s about unlocking a new level of efficiency and customer satisfaction. By carefully selecting your CRM platform and focusing on key areas like data security, seamless technology, and continuous training, you’re setting your business up for success. Remember, the goal is to make your financial operations as smooth and effective as possible while ensuring your customer interactions are more meaningful than ever. With the right approach and tools, your journey towards a fully integrated financial CRM system will not only meet but exceed your business and customer expectations. So, take the leap, follow the best practices outlined, and watch as your financial services transform into a powerhouse of efficiency and customer engagement.

Frequently Asked Questions

What is financial data integration in CRM systems?

Financial data integration in CRM systems involves linking financial information with customer relationship platforms like Salesforce or Microsoft Dynamics 365. This process ensures a unified and comprehensive view of customer interactions and financial transactions.

Why is choosing the right CRM platform important?

The right CRM platform is crucial because it must be capable of integrating seamlessly with financial data, ensuring data security and compliance, and meeting the unique needs of a business. Popular choices include Salesforce and Microsoft Dynamics 365.

How does data security and compliance affect financial data integration?

Data security and compliance are paramount in financial data integration due to the sensitive nature of financial information. Adhering to data protection laws and implementing robust security measures prevent data breaches and ensure customer trust.

What is the preferred technology for seamless integration?

API-based approaches are preferred for seamless integration of financial data into CRM systems. They allow for real-time data exchange and updates, improving accuracy and efficiency in customer relationship management.

Why is staff training important in financial data integration?

Adequate training and support for staff are important as they ensure the team can effectively use the integrated system. Proper training enhances user adoption, minimises errors, and maximises the benefits of the CRM platform.

How often should the integration strategy be reviewed and updated?

The integration strategy should be regularly reviewed and updated to stay compliant with data protection laws and to meet evolving business needs. Regular updates ensure the system remains efficient and effective in managing customer relationships and financial data.

Why integrate financial systems with CRM at all?

But in a challenging world during COVID-19 and beyond, it might be time to think about a simple CRM solution. Something that you and your colleagues can access, wherever you are working. After all, it’s not so easy now to shout across the office or wander to a co-worker’s space to ask about a particular customer. What if you take a call from a customer and need some simple facts to be able to help them? We all need answers quickly – no one wants to wait while you phone around for information.

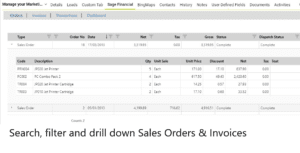

Integrating your financial software with a CRM system means you can view all of your customer’s financial data as well as keep track of your relationship with them. This means truly having a 360 degree view of all your customers and prospects.

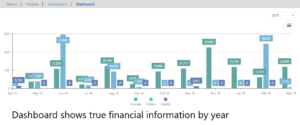

Sage Financials Data Connector

Maximizer CRM is a comprehensive, yet easy-to-use system. It comes at a much smaller premium compared to the big name CRM packages. You can quickly create a database with company information, contact details, notes, sales opportunities and even simple marketing campaigns. Everyone can access it remotely and via a Mobile App. As the database is live, you can tap into the latest, most up-to-date information. Empower your team’s ability to help a prospect or customer, improve your customer service and create prompts to remind you when actions need to be taken.

See it in action

You can also view the Sage Financials Data Connector in these videos:

Further information on how to integrate financial systems with CRM

Get in touch for more information about how you can maximise your understanding of your customers with an integrated financial and CRM system.